All About Matthew J. Previte Cpa Pc

Table of ContentsHow Matthew J. Previte Cpa Pc can Save You Time, Stress, and Money.Matthew J. Previte Cpa Pc - QuestionsMatthew J. Previte Cpa Pc for BeginnersMatthew J. Previte Cpa Pc Fundamentals Explained5 Simple Techniques For Matthew J. Previte Cpa PcWhat Does Matthew J. Previte Cpa Pc Do?

Tax legislations and codes, whether at the state or federal degree, are too complicated for many laypeople and they alter as well usually for several tax obligation professionals to stay on par with. Whether you just require someone to help you with your company income tax obligations or you have been billed with tax fraudulence, hire a tax attorney to aid you out.

The Buzz on Matthew J. Previte Cpa Pc

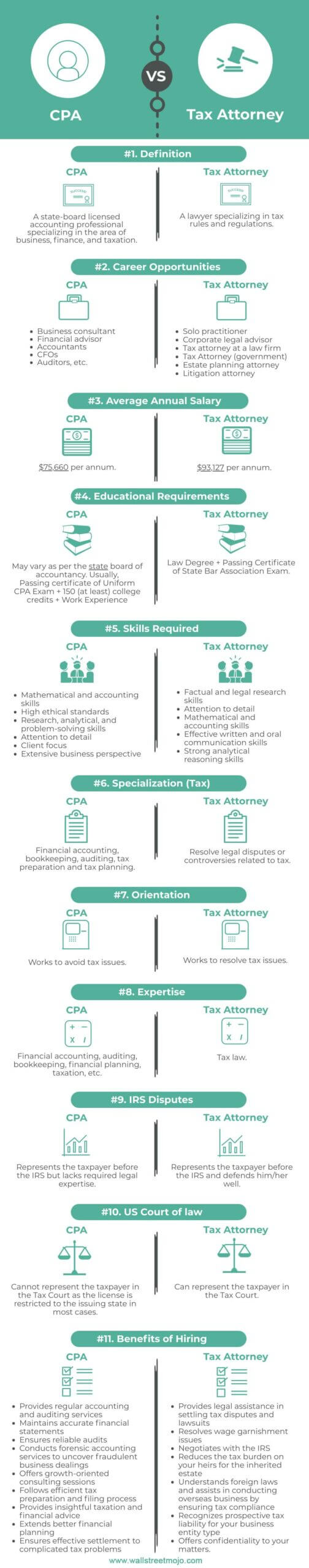

Every person else not only dislikes dealing with tax obligations, however they can be straight-out worried of the tax obligation agencies, not without factor. There are a few concerns that are always on the minds of those that are handling tax problems, including whether to work with a tax obligation lawyer or a CPA, when to work with a tax lawyer, and We intend to aid respond to those concerns here, so you recognize what to do if you locate on your own in a "taxing" situation.

An attorney can stand for customers prior to the internal revenue service for audits, collections and allures however so can a CPA. The large difference right here and one you require to bear in mind is that a tax attorney can provide attorney-client advantage, meaning your tax lawyer is exempt from being compelled to testify against you in a court of law.

What Does Matthew J. Previte Cpa Pc Do?

Or else, a CPA can testify versus you even while benefiting you. Tax lawyers are more accustomed to the numerous tax obligation negotiation programs than many CPAs and recognize exactly how to pick the most effective program for your case and exactly how to get you gotten approved for that program. If you are having an issue with the internal revenue service or simply questions and concerns, you require to employ a tax obligation lawyer.

Tax Court Are under examination for tax fraudulence or tax obligation evasion Are under criminal investigation by the internal revenue service One more important time to work with a tax lawyer is when you get an audit notification from the internal revenue service - Federal Tax Liens in Framingham, Massachusetts. https://pastebin.com/u/taxproblemsrus1. A lawyer can connect with the IRS in your place, be existing throughout audits, aid discuss settlements, and keep you from paying too much as a result of the audit

Part of a tax lawyer's task is to stay on top of it, so you are safeguarded. Your best resource is word of he has a good point mouth. Ask around for an experienced tax obligation lawyer and check the internet for client/customer reviews. When you interview your selection, request for additional referrals, especially from clients that had the exact same issue as your own.

Not known Details About Matthew J. Previte Cpa Pc

The tax attorney you desire has all of the ideal qualifications and endorsements. All of your concerns have actually been addressed. Unfiled Tax Returns in Framingham, Massachusetts. Should you employ this tax lawyer? If you can afford the costs, can accept the kind of prospective option offered, and have confidence in the tax lawyer's capability to help you, then yes.

The choice to work with an internal revenue service lawyer is one that need to not be taken gently. Attorneys can be incredibly cost-prohibitive and make complex issues unnecessarily when they can be fixed reasonably conveniently. Generally, I am a huge supporter of self-help legal options, especially provided the selection of educational product that can be discovered online (including much of what I have published on taxes).

4 Simple Techniques For Matthew J. Previte Cpa Pc

Right here is a fast list of the issues that I believe that an IRS lawyer should be worked with for. Let us be entirely honest momentarily. Offender costs and criminal examinations can damage lives and carry very major repercussions. Anybody that has hung around in prison can fill you in on the realities of jail life, yet criminal costs often have a much a lot more punishing impact that lots of people fail to think about.

Bad guy costs can additionally carry added civil fines (well past what is common for civil tax issues). These are simply some instances of the damages that even just a criminal charge can bring (whether or not an effective sentence is inevitably obtained). My factor is that when anything potentially criminal develops, also if you are simply a prospective witness to the issue, you require a seasoned internal revenue service attorney to represent your interests against the prosecuting company.

This is one circumstances where you constantly need an IRS attorney enjoying your back. There are lots of components of an Internal revenue service lawyer's job that are relatively regular.

Matthew J. Previte Cpa Pc Things To Know Before You Buy

Where we gain our stripes however gets on technical tax obligation issues, which put our complete capability to the test. What is a technical tax obligation concern? That is a hard inquiry to respond to, but the very best way I would certainly define it are issues that need the specialist judgment of an IRS lawyer to solve effectively.

Anything that possesses this "fact reliance" as I would call it, you are mosting likely to intend to generate a lawyer to talk to - tax attorney in Framingham, Massachusetts. Also if you do not retain the services of that lawyer, an expert point of sight when dealing with technical tax obligation issues can go a long way towards recognizing issues and settling them in a suitable fashion